| 09-17-2011, 03:10 PM | #1 |

|

Private First Class

26

Rep 127

Posts |

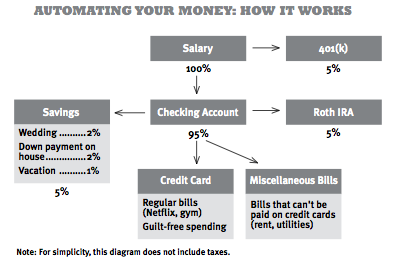

What Do You Guys Think Of This Personal Finance Automation Strategy?

I read this on a recent blog but what do you guys feel about this? I feel like 5% into savings per month is a little on the low side?

Automating your Personal Finances |

| 09-17-2011, 03:23 PM | #2 |

|

Guardian of the Night

111

Rep 1,831

Posts

Drives: 2010 335i M Sport Coupe

Join Date: Oct 2010

Location: San Antonio

|

5% is better than most peoples 0% per month.

__________________

2010 335i M Sport Coupe -- Black Sapphire Metallic|Coral Red|Loaded|JB4 Stage 3|BMS DCI|VRSF DPs|Camaross 6k AE|Performance Gloss Black Grilles|CF Performance Spoiler|CF Quad Diffuser|Double Layer Black Chrome Quad Tips|CF Roundels|Smoked Reflectors|Red Cyba Scoops|193s Painted Lamborghini Metallic Dark Gray 2010 335i M Sport Coupe -- Black Sapphire Metallic|Coral Red|Loaded|JB4 Stage 3|BMS DCI|VRSF DPs|Camaross 6k AE|Performance Gloss Black Grilles|CF Performance Spoiler|CF Quad Diffuser|Double Layer Black Chrome Quad Tips|CF Roundels|Smoked Reflectors|Red Cyba Scoops|193s Painted Lamborghini Metallic Dark Gray |

|

Appreciate

0

|

| 09-17-2011, 04:41 PM | #3 |

|

Lieutenant General

970

Rep 15,818

Posts |

So what did he say that was new?

I want my 10 minutes back...this is all common sense...automated payments, bill pay etc...this stuff isn't new....

__________________

|

|

Appreciate

0

|

| 09-17-2011, 06:38 PM | #4 |

|

Colonel

1201

Rep 2,132

Posts |

Stupid.

1) 5% to your 401k will only be $5,000/year if you make $100,000, not enough. I'm sure the person doing this makes less than $100,000 since they are doing a Roth IRA. 2) The "savings" account isn't savings if you're saving for a wedding, vacation, or down payment on a house. Savings should be 12 months of living expenses or renamed to "emergency fund." Once you have 12 months of expenses saved, you can call your savings account your wedding/house/vacation fund. 3) The only real "savings" I see here are the 5% and 5% buckets for 401k and roth. That means 90% of your income is going toward bills like Netflix (waste) and saving for a wedding. If you can't save more than 10% of your income, you are in bad shape and need to cut some bills (in my opinion). Last edited by BayMoWe335; 09-17-2011 at 06:51 PM.. |

|

Appreciate

0

|

| 09-17-2011, 09:38 PM | #5 | |

|

Captain

188

Rep 962

Posts |

Quote:

this, all these damn 'finance' people coming out of the woodwork quoting what should be common sense is driving me nuts |

|

|

Appreciate

0

|

| 09-18-2011, 07:23 PM | #6 | |

|

Lieutenant General

970

Rep 15,818

Posts |

Quote:

12 months is too much IMO for someone in their early to mid 20s. I feel 6 months is full expenses covered is more than sufficient. Personally, I feel this is the time to invest your money (wisely) and make it grow, rather than just have it sit in a low interest savings acct. Now, if you put that in a high dividend yielding stock, that's something else. Also, the market is in a situation now that, no matter what big stock you invest in to, it will eventually go up. I don't mean the risky, who knows if they will go bankrupt stocks I also don't put money away for IRA/401k. At this point in my life, I have specific financial goals I need to reach. Using my money to invest in various markets is the only way I will be able to reach these goals. Putting money away for 40 years in the future is not something I find worth it to do. I would rather take that 5% 401K and put it in a bank stock, or hell even into a high div yielding stock (I'm not a huge fan of them as, although they give a good 10-15% annual return, it's just not high enough). Though I am personally putting quite a money into these high div stocks...... as I'm 'saving' for a complex.... I personally feel that the only way for America to really get back on its feet is if Americans as a whole become more financially educated. I took Econ and Investments while in high school, and I have used what I learned in those classes more than all of my arts, music and language classes combined... I'm not saying take away arts/languages... but I feel that Investments (or personal finance) should be a requirement, and not just in high school, but starting early, in say middle school. I'm not a teacher, nor do I know how to teach a classroom, so I can't tell you how to do this...but I am confident that if we start teaching our kids personal finance at an early age, it will extremely benefit the future of America. I'm not saying turn each of them into investment bankers lol I am in debt to my parents as they never bought me anything (at the time I hated them for this)...but they gave me an allowance and said that for every week I don't collect it, they would add $$ to it; a simple way of imitating an interest earning account.

__________________

|

|

|

Appreciate

0

|

| 09-18-2011, 07:53 PM | #7 | ||

|

Colonel

1201

Rep 2,132

Posts |

Quote:

You can buy the stocks you want and put them in the Roth IRA. My 12 months of liquid savings doesn't have to be a 0.75% savings account. High quality yielders that are easily liquidated are just fine too...point is, it has to be liquid or easily made liquid. I fully advocate investing your own portfolio and do so myself, but only after you have saved, contributed to tax deferred accounts, and completely paid off all debt (or at least somewhat high interest debt). I know 10-15% yielders exist, but you have to question their ability to pay a consistent dividend at that rate over the long term. There is a reason people buy T-Bills or stocks like Verizon and AT&T in favor of Nokia which yields almost 10%. I know there are some REITs and other stuff out there, but 10-15% yielders aren't a sure thing...if they were, everyone would do it as that would more than double your money every 7 years. Best of luck to you. You have to realize at a young age that even success in beating the market is only temporary. I have outperformed the market in several of my years of investing but realize it only takes one mistake to be humbled. Quote:

Last edited by BayMoWe335; 09-18-2011 at 08:02 PM.. |

||

|

Appreciate

0

|

| 09-19-2011, 12:56 AM | #8 | |

|

Lieutenant General

970

Rep 15,818

Posts |

Quote:

If, and that is a big if, I get employed where my employer would match (to a certain degree of course) what I contribute, then that would change everything. Also, I do understand their tax advantages, but for me, I don't need to worry about that for reasons I do not wish to get into. You are right about that statement being dangerous, but I didn't want to get into it. Also, in regards to the high div stocks, you are right that they aren't perfect. That is why one needs to watch them, and if need be, sell and get out. I personally have them set that if they drop to a certain amount, they will automatically be sold. I do have to update this every so often though. I don't play the market only for profit (though that is the main reason), I do enjoy the 'thrills' it brings...I guess at my age I can handle the stress and heart-throbbing drops lol. Maybe I need more excitement in my life, who knows. And yes, a liquid-type savings, not having to be a .75% account. Since you didn't specific this, and the video among mentioned a 'saving account," i wrongfully assumed what you mean, my apologies. The main reason I haven't begun any planning for retirement is that I would much rather live now, invest for today, invest for tomorrow, and then, once I have reached my specific goals, begin putting away for retirement. I do have a retirement 'strategy' (if you can call it that), that I will most likely modify quite a bit when the time comes... but I just don't see any personal benefits into putting $ aside for 40+ years down the road. Since I'm only in my early 20s, I am well aware of my lack of wisdom and experience, and I do admit I have made plenty of financial mistakes in the past and continue to make in the future; but I am proud to say that I do learn from my mistakes and do what I can to not make them (or at least, do what I can do limit them..). This website does not help at all.... I've spent over 10k on my M3 just since May.... not financially wise at all.... O well, it is what it is  . .

__________________

|

|

|

Appreciate

0

|

Post Reply |

| Bookmarks |

| Thread Tools | Search this Thread |

|

|