| 04-12-2022, 12:50 AM | #1 |

|

Major

1408

Rep 1,146

Posts |

bonus question

as an incorporated contractor,

if I decide to pay myself a bonus, do I have to pay tax on it ? so let's just spit ball, I pay myself say a $500 end of year/end of contract bonus, just because I deserve it  (out of my company funds) do I have to deduct tax from it (out of my company funds) do I have to deduct tax from ittxs |

| 04-12-2022, 10:20 AM | #4 |

|

Major

1408

Rep 1,146

Posts |

|

|

Appreciate

0

|

| 04-12-2022, 10:37 AM | #5 | |

|

Lengthy but not a Girthy Member

1287

Rep 130

Posts

Drives: 1971 Honda Civic

Join Date: Aug 2017

Location: Riding the high seas of your emotions

|

Quote:

|

|

|

Appreciate

1

nazali1408.00 |

| 04-12-2022, 10:40 AM | #6 | |

|

Major

1408

Rep 1,146

Posts |

AWESOME ! txs

Quote:

|

|

|

Appreciate

0

|

| 04-12-2022, 10:57 AM | #8 |

|

Lengthy but not a Girthy Member

1287

Rep 130

Posts

Drives: 1971 Honda Civic

Join Date: Aug 2017

Location: Riding the high seas of your emotions

|

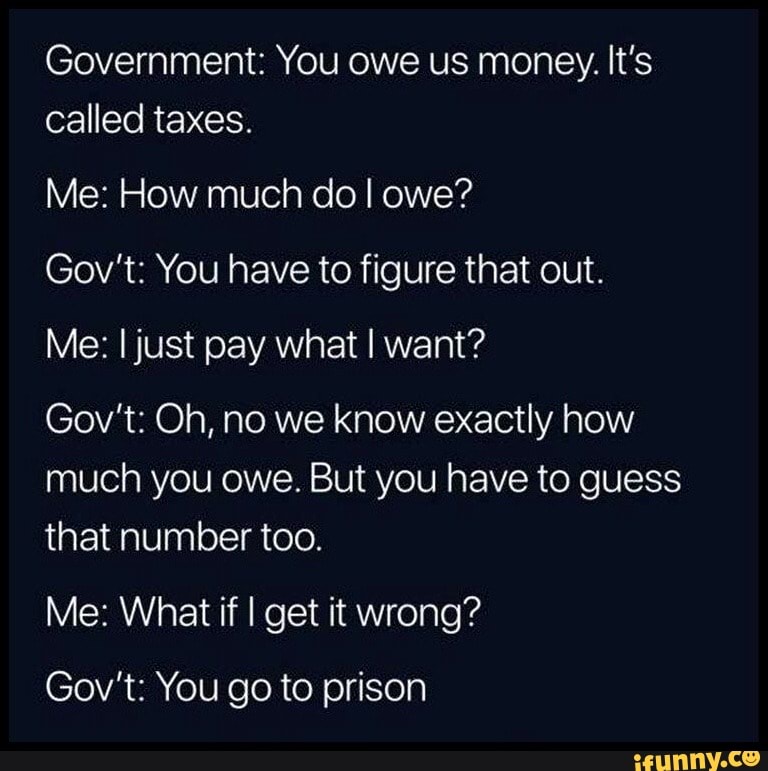

No problem. It is what I do for a living. I'm one of the rare people that enjoy doing taxes...although I can't say I enjoy reading the income tax act. Swear it is written in a different language despite the use of english words.

But again, if you're not in Canada, its a moot point - every country has different laws. And you should probably let people know where you are operating so they can give better advice. |

|

Appreciate

1

nazali1408.00 |

| 04-12-2022, 11:16 AM | #9 |

|

Lieutenant

1594

Rep 402

Posts |

I'm a CPA. However, my focus is not on tax so take this with a grain of salt.

From my understanding, the Inc. and you yourself are considered two separate entities. Therefore, it's still considered income even though you're paying yourself and would need to deduct taxes at some point. Either at time of payment or at year end when you file taxes. |

| 04-12-2022, 12:46 PM | #10 | |

|

Colonel

8071

Rep 2,500

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

How many employees, including yourself, are in the company? |

|

| 04-12-2022, 12:46 PM | #11 |

|

Captain

3905

Rep 1,003

Posts |

In the USA, if any inc. pays you, that is taxable income to you. If the inc regularly pays you wages, the bonus will be added to that and taxed accordingly. Taxes must be withheld per the IRS. Go to irs.gov and look for employment taxes (you’ll either want a tax CPA or to get very familiar with this web site).

If this is the only payment made by the inc to you in the year and you are not an employee of the inc, it might be considered a payment for services as an independent contractor by the inc and the inc should issue a 1099 to you at the end of the year (actually January). However there is a minimum annual amount that requires a 1099 and I think the $500 in the example is below the threshold. But again, irs.gov. (It is still taxable to you, but there may not be a 1099 issued by the inc). Finally, the payment could be either a dividend (1099-div) or a return of capital. So four different ways to characterize a one-time payment: wages/bonus, independent contractor, dividends, return of capital. The difference is not what you want it to be, it is what the law says based on the nature of the payment. Also note that generally the business (inc) side of this is a mirror to your side. If it is taxable wages/bonus to you, it is payroll and deductible to the inc (but also subject to withholding for income taxes, state taxes, FICA, etc). If a 1099 payment, it is tax deductible as an expense to the inc. If a non-taxable return of capital, it is a non-deductible distribution of capital. Simple question but a pretty weedy area of tax law. |

|

Appreciate

2

leopard print1594.00 nazali1408.00 |

| 04-12-2022, 01:51 PM | #12 | |

|

Lieutenant

1594

Rep 402

Posts |

Quote:

|

|

|

Appreciate

1

nazali1408.00 |

| 04-12-2022, 04:54 PM | #13 | |

|

Major

1408

Rep 1,146

Posts |

I cannot divulge where I am from Eh !

Quote:

|

|

|

Appreciate

1

Buug95923330.50 |

| 04-12-2022, 04:56 PM | #14 | |

|

Major

1408

Rep 1,146

Posts |

yes that's true, my contract firm pay's MY company (my inc) and my INC pays me, yes, 2 separate entities, O just guess I can guess a nominal figure or wait till I file, no biggie

Quote:

|

|

|

Appreciate

0

|

| 04-12-2022, 04:58 PM | #15 |

|

Major

1408

Rep 1,146

Posts |

ok good question,

my company name is 12345 xyz inc. I'm incorporated and have articles of incorporation, one employee, me, I'm in IT, I'm listed as the director, not-US, could be ya little brother |

|

Appreciate

0

|

| 04-12-2022, 05:00 PM | #16 | |

|

Major

1408

Rep 1,146

Posts |

txs a lot of good info in there !

txs again for taking the time to explain in that amount of detail Quote:

|

|

|

Appreciate

0

|

| 04-12-2022, 05:02 PM | #17 |

|

Major

1408

Rep 1,146

Posts |

thank you all for your valuable input, I do have a CPA, and I'll run it past them in due course. I get paid this week and I want a little extra bonus, BECAUSE I DESERVED IT LOL

thank you again all ! |

|

Appreciate

1

leopard print1594.00 |

| 04-12-2022, 05:40 PM | #18 |

|

Colonel

5964

Rep 2,022

Posts |

I'm an s-corp and my understanding is everything the company makes gets funneled through my personal taxes so I can "pay" myself whatever I want. Although I believe I still have to pay myself a certain amount as an employee in order to pay payroll taxes like ss.

It's confusing as fuck, that's why I have an accountant for taxes. Only thing I don't do myself.  |

| 04-12-2022, 09:01 PM | #19 |

|

Colonel

8071

Rep 2,500

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Please do yourself a favor and be certain what corporate entity type you created. Said with kindness, and because you said you don’t know what the abbreviations meant. These are basic business concepts that you need to understand.

Chances are your company is a disregarded entity and income (not revenue) flows through to your personal tax return. If you file in the U.S. there are no games that can legally be played to pay oneself bonuses, or other similar schemes, to reduce income and therefore pay less tax. In the end Uncle Sam gets what’s his. Income, and therefore taxes, can be reduced by deducting legally allowable expenses. Last edited by chassis; 04-12-2022 at 09:07 PM.. |

|

Appreciate

1

nazali1408.00 |

| 04-12-2022, 10:18 PM | #20 | |

|

Major

1408

Rep 1,146

Posts |

txs, appreciated, I'm not in the US, so those abb's don't really mean a lot to me. I can either be a T4'd contractor or incorporated contractor.

I charge HST on my invoice to the client and then I pay myself an amount, I put asside, federal/prov. taxes, CPP and HST, Payroll is something I do have to do, I recently found a CPA whoes giving me a great advice, I just don;t wanna go running to them for every little thing. I'm not really trying to play any games, I have a ledger, log my incoming and outgoing, millage and expenses. But I just wanted (since my contract renewed) give my self a little bonue over and above what I pay myself. I'm in profit on my company books, I have multiple accounts for buisness, taxes, personal where I move my money around (not to hide) but so that I can see whats what. I keep invoices, receipts and make claims on company business. I was told come filing time a good stratagy is a mixture of dividends and pay, but after they've gone through my books they can assess better. Quote:

|

|

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|